"Trinidad is not facing one crisis. It's facing three. And they're all hitting at the same time."

STORM 1: Dragon Gas Delayed (Geopolitical)

April 2025: US OFAC license suspended.

October 2025: Negotiation-only license issued.

2026 Status: ZERO production. No revenue injection.

Impact: The "savior" revenue becomes 2027+ problem.

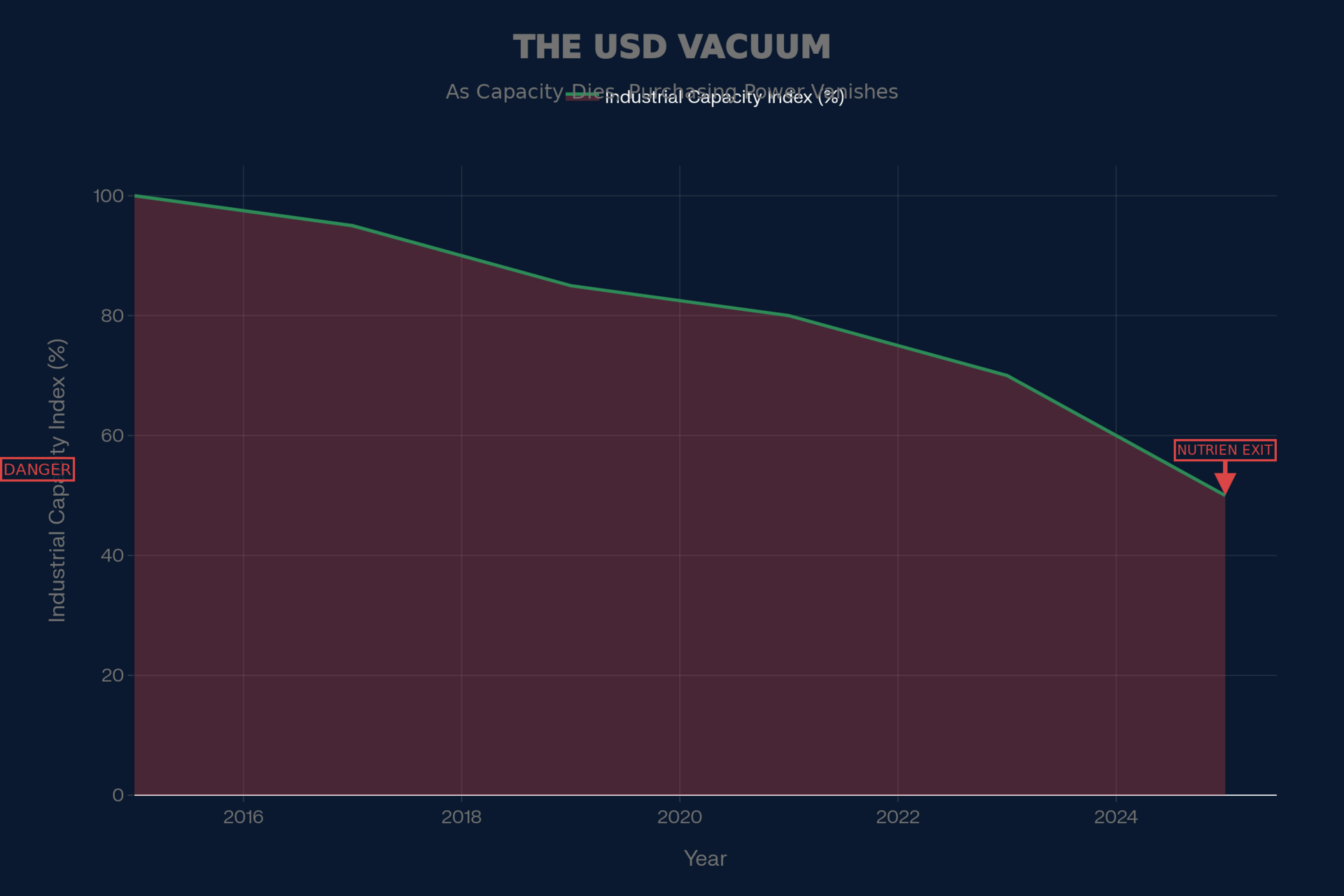

STORM 2: Nutrien Just Exited (Industrial Collapse)

October 2025: Nutrien controlled shutdown—entire nitrogen complex offline.

Jobs Lost: ~600 direct + 1,600 indirect.

Revenue Lost: $854M USD/year.

Reason: Unreliable gas + port access disputes.

Precedent: Follows Yara (2019), Train 1 (2025), Methanex (2024).

STORM 3: Forex Cliff (Liquidity Crisis)

Reserves: $11.5B (2014) → $4.6B (Aug 2025).

Import Cover: 4.6 months (already below IMF 6-month threshold).

Nutrien Bleed: $71.2M USD/month lost.

2026 Forecast: Import cover drops to 3.2 months by year-end.

The US Dollar Vacuum: No Plants = No Imports

💀 THE "DE-CLUSTERING" MULTIPLIER

Point Lisas was built on shared infrastructure (1 port, 1 pipeline, 1 labor pool for 20 plants). When Nutrien exits, remaining plants inherit the full infrastructure cost burden. Unit costs spike. Next plants close. Cascade effect.

🇻🇪 VENEZUELA SPILLOVER

Airspace Risk: Regional flight disruptions. Tourism: -$200M/yr.

Migration: 34,740 Venezuelans in T&T system. Pressure accelerates with escalation.

Sanctions Contagion: Banks tighten Caribbean exposure. Higher insurance costs.

🔴 WHERE THIS LEAVES TRINIDAD

By Q3 2026:

Reserves near critical levels (<$3.5B).

Currency float forced (TT$ slides from 6.7:1 to 8:1).

Import inflation spikes (food, medicine, fuel).

Proman/Methanex margin squeeze accelerates exit risk.

The Choice (All Bad):

Float now (Controlled depreciation, painful but manageable).

Import controls (Rationing, black market explosion).

IMF bailout (Austerity, public sector cuts).

Regional pivot (Higher costs, lower volumes, diaspora deals).

Reality: Expect combination of Float + IMF by Q4 2026.

⚡ THE 90-DAY AGENDA

Secure Dragon: Get full OFAC production license by March 2026. If stalled, accelerate domestic deepwater.

Save the Cluster: Emergency subsidy for remaining plants (~$150M TT$) for 12 months.

Float the Peg: Managed depreciation to 7.2:1 by March 2026. Pair with wage indexing for vulnerable groups.

Diaspora Bond: Raise $300-500M USD from T&T diaspora (7-8% USD bond, 5-year term).

Regional FX Deals: Jamaica, Guyana, DR prefer official rates on regional trade. Build Caribbean clearing house.

🎯 THE BOTTOM LINE:

2026 is the survival year. 2027 is the salvation year (if Dragon produces).

Without aggressive action in the next 90 days, T&T enters managed decline. The window is closing.

CBI Intelligence Unit | Jan 5, 2026 | Ref: PERFECT-STORM-TT-26